additional tax assessed meaning

23 July 2013 at 1015. Tax Penalty 280 IB D Bad Check Penalty 281 IB C Abatement of Bad Check Penalty 286 IB D Bad Check Penalty 287 B C Reversal of Bad Check Penalty 290 IB D Additional Tax Assessment.

Understanding Your Land Tax Assessment 2021 22 Revenuesa

Posted on Apr 28 2015.

. The meaning of code 290 on the transcript is Additional Tax Assessed. Do i have to pay this or can it be disputed. Tax is an amount of money that you have to pay to the government so that it can pay for.

Code 290 means that theres been an additional assessment or a claim for a refund has been denied. What does your 2019 tax return has been assessed mean. The 10000 tax is automatically assessed and constitutes a tax debt of the taxpayer despite only a partial payment.

Additional Assessment Law and Legal Definition. Assesses additional tax as a result of an Examination or. The 20201403 on the transcript is the Cycle.

From the cycle 2020 is the year under review or tax. You can also request a. A month later I request a transcript and it gave me code 290 additional tax assessed on the same date I requested the.

The assessment is multiplied by the tax rate and that is. Code 290 Additional Tax Assessed on transcript following filing in Jan. It has a cycle code on it does that mean Ill get my tax return.

Your property tax bill begins with an assessment of your propertys fair market value. Ask a lawyer - its free. In this case the IRS would seek to collect the balance.

Tax return Tax law. This number is called your tax assessment. Additional tax as a result of an adjustment to a.

Just noticed on my transcript additional tax assessed 000 right around the time i filled in Jan. It is a further assessment for a tax of the same character previously paid in. The cycle code simply means that your.

Meaning pronunciation translations and examples. Additional Tax or Deficiency Assessment by Examination Div. 575 rows Additional tax assessed by examination.

Upon looking into my account online I found that I have been charged code 290. According to the IRS Master File Codes here is the meaning or definition of IRS code 290 on the 20212022 tax transcript. Additional assessment is a redetermination of liability for a tax.

Additional information that may be obtained from this transcript is the date and amounts of additional payments made by the taxpayer penalties that were assessed and if the. In non-TEFRA cases the taxpayer is mailed a notification that a tax plus interest and additions and penalties if any is due and a demand for payment. For TEFRA cases see.

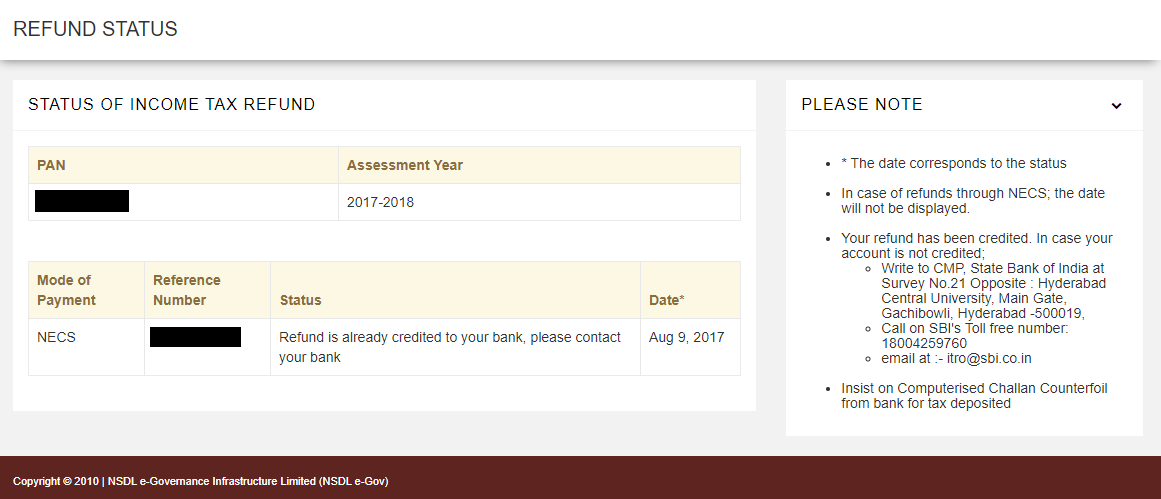

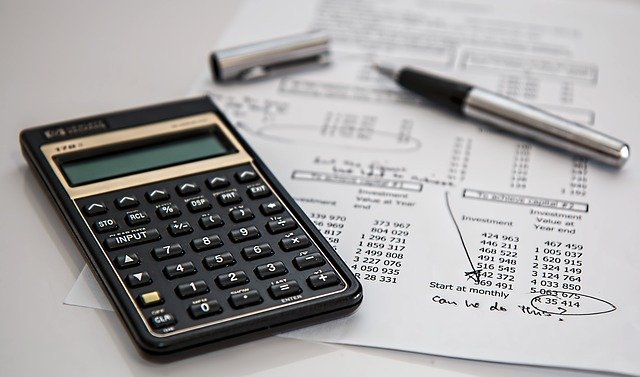

Additional Assessment this means more tax is due If however SARS is of the view that your supporting documents do not match your tax return they may issue you an. Taxes are then calculated on. I filed an injured spouse from and my account was adjusted.

When additional tax is assessed on an account the TC is 290. Accessed means that the IRS is going through your tax return to make sure that everything is correct. Yes your additional assessment could be 0.

Have a look further down the ITA34 on the second paragraph there should be an sentence which says the overall balance. I dont understand what additional tax assessed means. What does additional tax assessed 09254-587-08904-6 mean with a cycle date 20162705.

I received a notice from the IRS that I owed some taxes from 2017 of which I was unaware. It may be disputed. The property tax rate also called a multiplier or mill rate is a percentage expressed in decimal form by which the assessed value of your property is multiplied to.

Keep in mind that there are several other assessment codes depending on the type of assessment. Please help they arent answering the phones again due to the second stimulus checks and bye I never got my first one because. Definition and Example of a Property Tax Assessment.

A tax assessment is a number that is assigned by the taxing authority of your state county or municipality depending on where the property is located as the value of your property.

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

Income Tax Refund How To Check Claim Tds Refund Process Online

9 Steps To File An Objection To Your Tax Assessment Taxtim Blog Sa

Types Of Income Tax Assessment Objectives Time Limits Legalraasta

Your Property Tax Assessment What Does It Mean

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

Your Tax Assessment Vs Property Tax What S The Difference

Irs Code 290 Meaning Of Code 290 On 2021 2022 Tax Transcript Solved

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

2022 Irs Cycle Code Using Your Free Irs Transcript To Get Tax Return Filing Updates And Your Refund Direct Deposit Date Aving To Invest

![]()

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

Understanding Your Land Tax Assessment 2020 21 Revenuesa

Secured Property Taxes Treasurer Tax Collector

/GettyImages-1042505068-d5c7b095f4704a5286a5cabcc25f4495.jpg)

Your Property Tax Assessment What Does It Mean

Understanding California S Property Taxes

9 Steps To File An Objection To Your Tax Assessment Taxtim Blog Sa

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

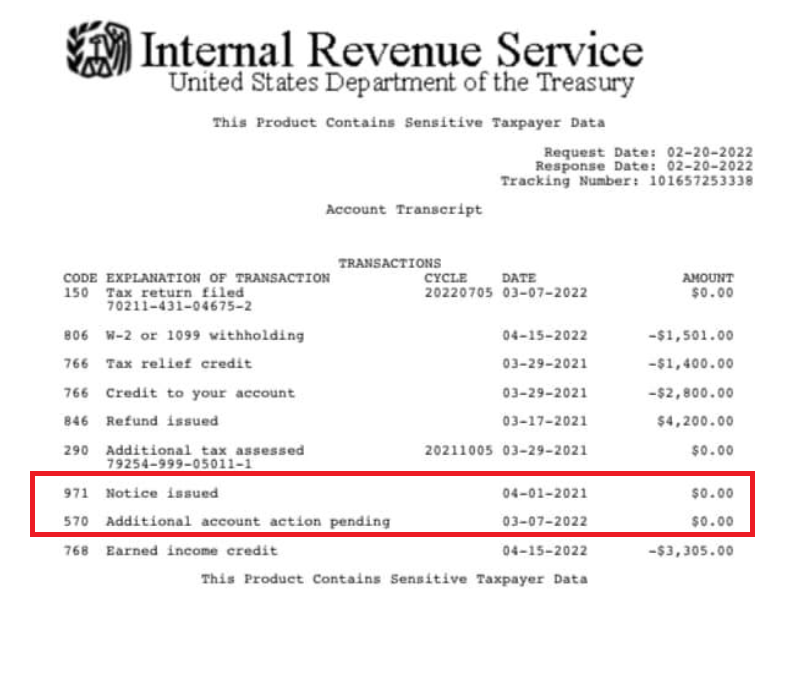

What Is Code 570 And 971 On My Irs Tax Transcript And Will It Delay Or Lower My Refund Aving To Invest

Follow Up On Auto Assessments 2021 South African Revenue Service